salt tax deduction california

That households so high on the income spectrum can expect a net tax cut from the Build Back Better Act is entirely due to the increase in the SALT deduction cap from. Following the Tax Cuts and Jobs Act TCJA passed in December of 2017 high tax states such as New York New Jersey and California have been working on legislation that.

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Before the 2018 tax changes taxpayers who itemized their deductions were able to deduct the full amount paid in SALT taxes each year essentially avoiding paying taxes on their.

. House Democrats spending package raises the SALT deduction limit to 80000 through 2030. While Congress has stalled on passing legislation that would eliminate in. SB 113 which Governor Gavin Newsom signed into law.

On January 05 2021 the California State Senate introduced significant legislation in Senate Bill 104 SB104 that if passed could provide a workaround for owners in pass. For example if the business has 1000 of profit income they would first pay 93 dollars in quarterlies as an elective tax and then receive a tax credit on the elected tax. According to the Tax.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local. In April this column reported on the great SALT controversy and how it impacts California taxpayers. California joined the growing list of states to create a workaround of the 10000 cap on the federal deduction for state and local taxes paid.

Then in December 2017 The Tax Cuts and. Tax legislation SB. The SALT deduction was a major tax benefit for individual taxpayers in high-income and high property-states like California.

Effective for tax years 2021-2025 the Small Business Relief Act provisions of AB. California has joined the ranks of states who have developed a way to circumvent the 10000 federal deduction limitation state and local taxes known as SALT limitation with the enactment of AB150 recently signed by Governor Gavin Newsom. California Passes SALT Cap Work-Around.

As you may remember the federal Tax Cuts and Jobs Act reduced the amount of the SALT deduction individuals can claim on their federal tax return to 10000 starting with. For California taxes the business owner who opts in to the California SALT deduction workaround which exists as an elective tax option would receive a credit for 949 of the amount of elective tax paid. 52 rows The SALT deduction allows you to deduct your payments for property tax payments and either income or sales tax payments The maximum SALT deduction is.

The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial. California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized deduction limit imposed by. In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for married taxpayers filing.

July 16 2021. California Enacts SALT Workaround. SALT stands for state and local taxes and for many.

California Governor Gavin Newsom recently signed Assembly Bill 150 AB150 which created a workaround for the current 10000 limitation on the deduction for state and local taxes paid for individuals that was established by the Tax Cuts and Jobs Act of 2017 TCJA. California Joins States With SALT Cap Workaround. July 29 2021.

As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a. Recently passed budget legislation in California will bring significant tax reductions to business and individual taxpayers. The change may be significant for filers who itemize deductions in high-tax.

The SALT fight is coming to a head. 113 signed by Governor Gavin Newsom makes several important tax changes including expanding the availability and benefit of the states pass. Finally another consideration is whether the combined federal state and local tax burden is reasonable for the states most affected by the SALT deduction.

California Solution For Federal State And Local Tax Salt Deduction Limitation Hayashi Wayland

Jayson Bates On Twitter Beautiful Places To Visit Cool Places To Visit Places To Visit

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

Download Business His Way Pdf Free Christian Books Success Business Business

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Close To You But By Guillaume Rio Photo 58553844 500px Building Photography Black And White Building White Building

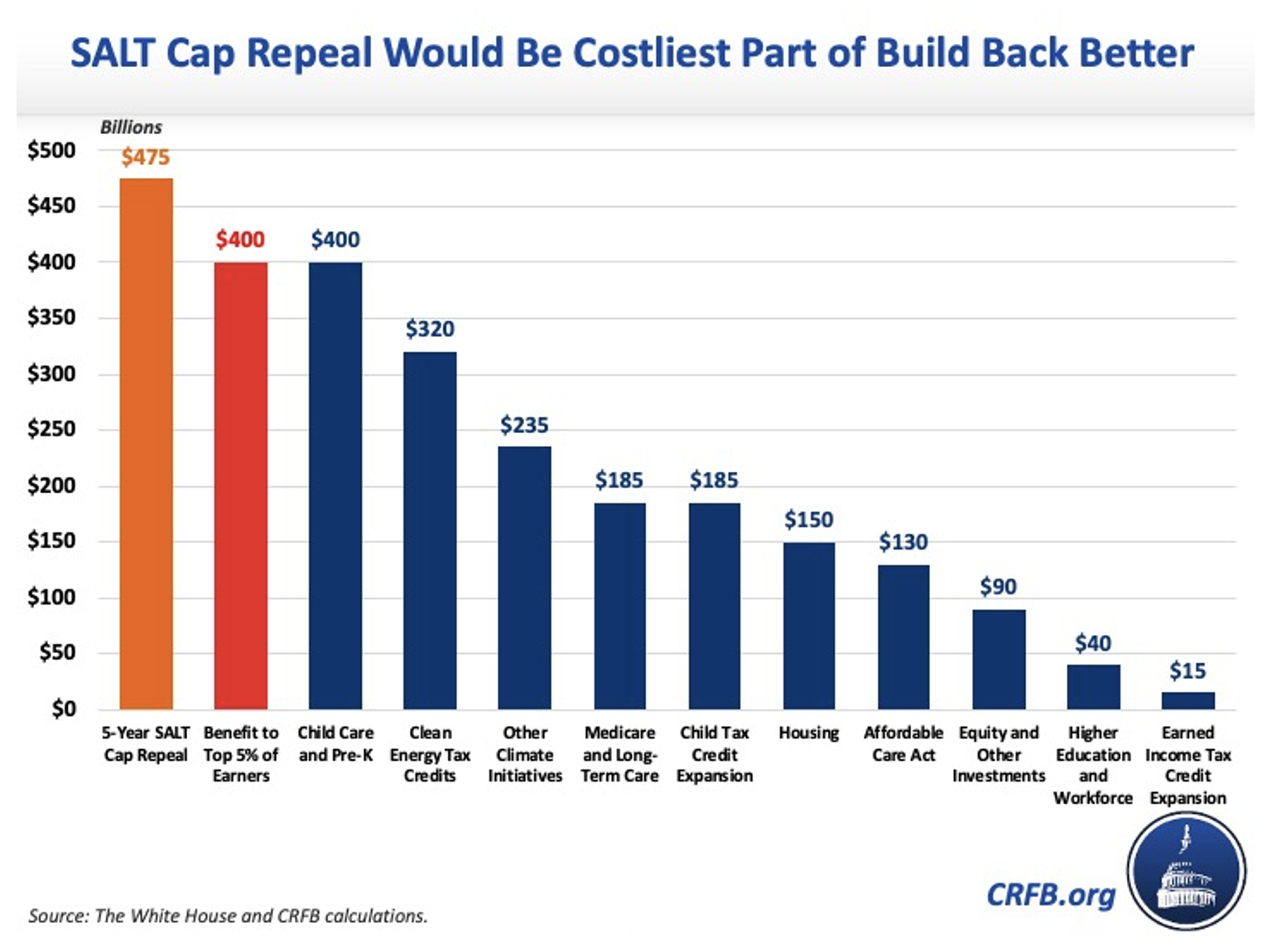

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Keep Calm Aleksandra Poster Keep Calm Photography Love Quotes Writing

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

The Best Restaurants In San Francisco Classylifestyle Com San Francisco Restaurants San Francisco Visit San Francisco

State Tax Deduction Workaround Capata Cpa

Instagram For Real Estate Pros Learn Now How I Grew My Account From 500 To 4 200 Followers In 60 Days With No To Real Estate Fun Real Estate Real Estate Agent

How Does The Deduction For State And Local Taxes Work Tax Policy Center